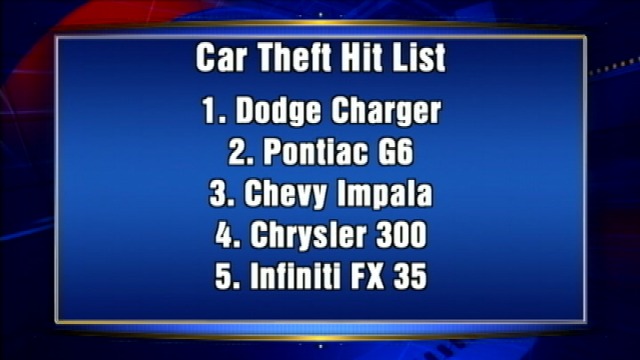

Auto insurance costs more in Atlanta than the rest of Georgia. Why? Well, Atlanta has a higher risk in addition to the related costs resulting from the claim. More traffic accidents occur around the metropolitan area because there are more people and more cars. Atlanta has a population of 443,775. Car insurance usually costs more in an urban area due to the higher risk of vehicle theft, accidents and vandalism. Georgia ranks in the top 10 states for auto theft. The peak season for vehicle thefts occur between July and August.

Additionally, metropolitan areas such as Atlanta experience road rage and speeders. In Georgia, the car insurance limits required are 25/50/25. The first two figures are referring to bodily injury liability while the third figure refers to property damage liability. For example, a policy has to cover up to $50,000 for all individuals injured in a single car accident. It is subject to a limit of $25,000 for one individual and $25,000 to cover property damage.

A policy usually covers six distinct risk areas, which are priced separately. They include: Bodily injury liability, Personal Injury Protection(PIP), collision, property damage liability, uninsured motorists’ coverage and comprehensive. However, it is important to note that a car insurance policy does not have to cover all these areas, so you need to read and understand your policy.

Atlanta is the ninth largest metropolitan area in the United States. While living in the city has its advantages, it also equates to higher premiums due to an increased risk. With the rising cost of healthcare, it is highly recommended that people have higher liability limits to protect their financial interests. Another aspect to pricing that some individuals do not realize is that their job can affect their insurance rates. Insurance is sold in different packages, so you should understand what will be covered before buying.

Call Waggoner Insurance today at (770)-434-4000

Source:

Fox Atlanta

Leave A Comment